killbait.com

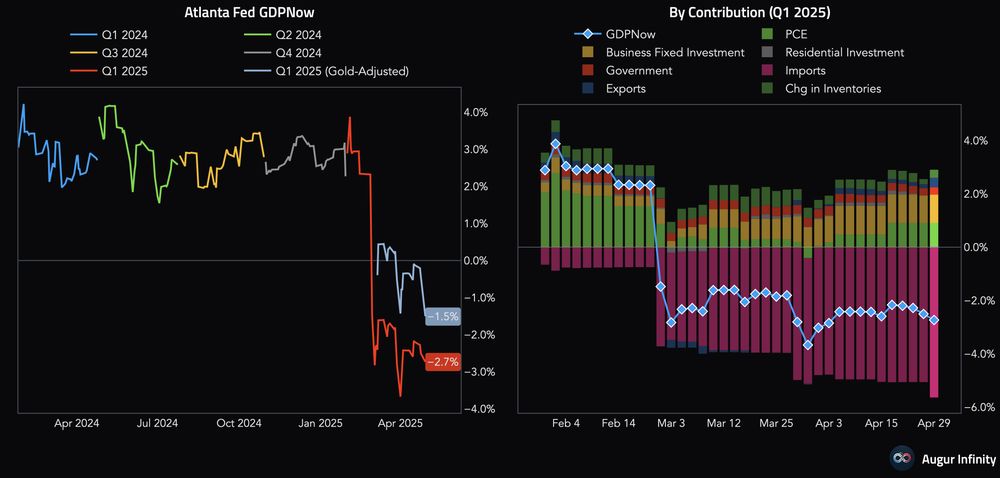

Market Turmoil Deepens Amid Trump’s Criticism of Fed Chair Powell

On April 21, 2025, U.S. financial markets experienced significant declines following former President Donald Trump’s intensified criticism of Federal Reserve Chair Jerome Powell.